coinbase vs coinbase pro taxes

This is especially true for FTXUS where taker fees start at 020 and maker fees start at 010. Both Coinbase platforms allow you to purchase cryptocurrency in dollar amounts allowing you to buy fractions of coins.

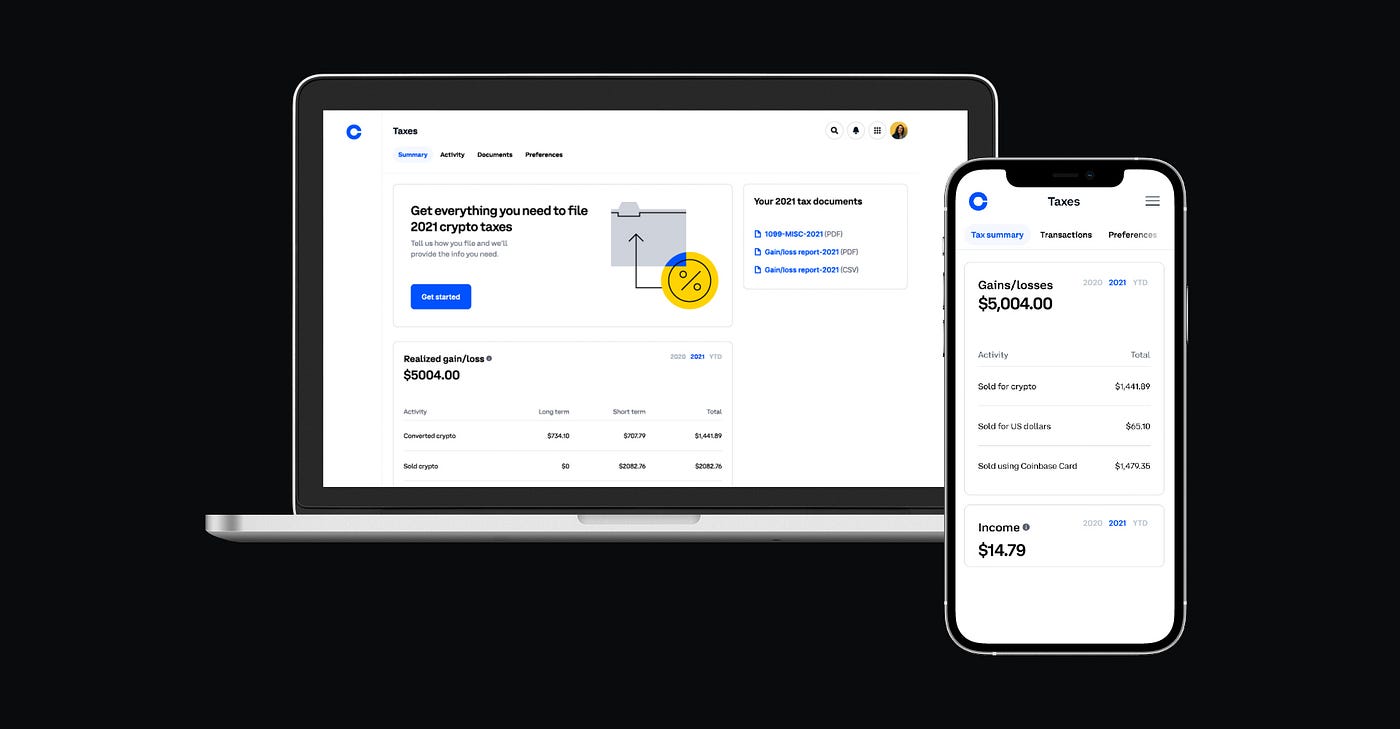

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

If you mined crypto youll likely owe taxes on your earnings based on the fair market value often the price of the mined coins at the time they were received.

. Under Profile Information in the API Settings tab click the NEW API KEY button at. Learn more about how to use these forms and reports. NDAX using this comparison chart.

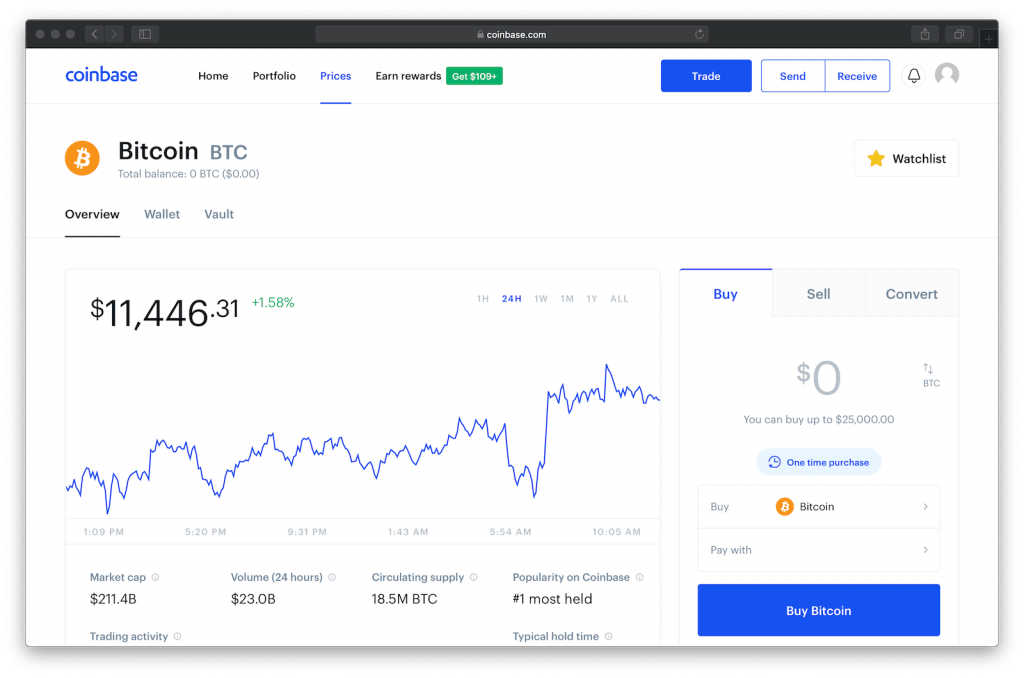

On Coinbase Pro you only pay the. Beginner Friendliness Considering. I have had my coinbase account since 2016 never any issue using it except for the occasional re-verification of my identity ever year or so.

Trade Republic offers over 40000 derivatives assets including CFDs with no commission charges or spread mark-ups. Within CoinLedger click the Add Account button on the top left. Coinbase charges a fee of 099 to 299 per trade depending on the size plus a spread of about 050 between buying and selling prices.

Visit Coinbase Pro API page. Trade Republic offers derivatives trading on a range of currencies. Coinbase Coinbase Pro Tax Reporting Via TurboTax Crypto Exchange Tax Filing Help.

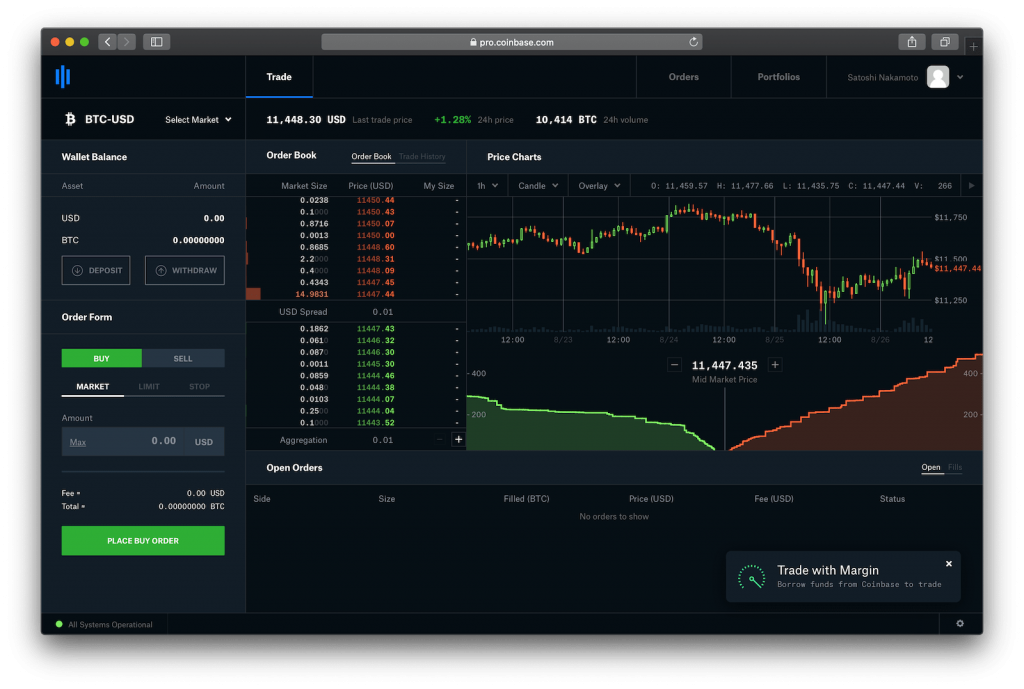

Go to Coinbase Pro GDAX API Keys. Coinbase has a 2 minimum order amount and. Coinbase Pro offers advanced charting tools and features and several order types.

If you are subject to US taxes and have earned more than 600 on your Coinbase account during the last tax year Coinbase will send you the IRS Form 1099-MISC. Compare price features and reviews of the software side-by-side to make the best choice for your business. Copy the Passphrase and paste into CoinTracker.

Leave the IP whitelist blank. Whereas on the other hand Coinbase is. Coinbase exchange charges a higher.

On Coinbase I bought ETH to hold. I bought and sold 40000 in crypto last year on. These Coinbase pro trading fees start at 060 and fall as the monthly trading volume of more significant volume dealers increases.

Click New API Key. Follow Twitter Follow YouTube Channel Follow. 1 3 minutes read.

You can download your tax report under Documents in Coinbase Taxes. Click Create API Key. Easy import of your transactions via API import from Coinbase Pro.

Youll receive the 1099-MISC form from Coinbase if you are a US. Find Coinbase Pro in the list of supported exchanges and select the import method you prefer. Bank transfers come with a 149 fee for buying and on the exchange the makertaker system comes with costs of between 01 to 025 depending on the volume you trade.

Coinbase Tax Resource Center. Under Permissions select View. This trading platform is designed for fast-paced spot trading and offers pricing based.

The premium version Coinbase Pro offers more types of transactions and charges much lower fees and is perfect for active traders. While Coinbase doesnt issue 1099-Ks they do issue the 1099-MISC form and report it to the IRS. In order to pay 15 tax I plan to hold them for at least 1 year.

Deposit and Withdrawal Methods Coinbase offers additional payment methods including PayPal withdrawals and credit card deposits. CoinTracker enables you to automatically sync all of your cryptocurrency activity on Coinbase Coinbase Pro and other walletsexchanges into one place so that you can securely and. I deposited 1000 but didnt buy anything yet.

2 days agoCoinbase offers its Coinbase Pro exchange which uses a tiered makertaker model but that is a separate system. Its trading fees are also. User1 January 13 2022.

On Coinbase Pro I didnt to anything yet. 14 hours agoA Coinbase Pro account gives you access to the Coinbase Pro crypto trading platform.

Coinbase Vs Coinbase Pro What The Difference Crypto Pro

3 Steps To Calculate Coinbase Taxes 2022 Updated

/Crypto_Com_Coinbase_Head_to_Head_Coinbase-5a1d16401652466496531dd1cf6e348a.jpg)

Crypto Com Vs Coinbase Which Should You Choose

Tax Forms Explained A Guide To U S Tax Forms And Crypto Reports Coinbase

Step By Step Guide How To Set A Stop Limit Stop Loss On Coinbase Pro 4k Youtube Technical Analysis Software Step Guide Technical Analysis

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

This Is How To Transfer From Coinbase To Coinbase Pro 2022

Coinbase Vs Coinbase Pro Is The Upgrade Worth It Zenledger

Coinbase Starter S Guide Bitcoin About Me Blog Cryptocurrency

The Ultimate Coinbase Pro Taxes Guide Koinly

![]()

Coinbase Makes It Easier To Report Cryptocurrency Taxes The Verge

The Ultimate Coinbase Pro Taxes Guide Koinly

Does Coinbase Report To The Irs Zenledger

The Ultimate Coinbase Pro Taxes Guide Koinly

Coinbase Vs Coinbase Pro What The Difference Crypto Pro

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

Cointracker Is The Most Trusted Bitcoin Tax Software And Crypto Portfolio Manager Automatically Connect Coinbase Binance And In 2021 Tax Software Tax Guide Bitcoin

Cardano Is Launching On Coinbase Pro Big News For Cardano Holders Ada Project Success Success Stories Investing